Mastering Student Loan Repayment: A Comprehensive Guide

Student loans, while instrumental in financing education, can often feel like a looming financial burden. The desire to liberate oneself from the shackles of student debt is universal, and if you're seeking ways to pay off your student loans faster while minimizing interest payments, you've come to the right place. In this comprehensive guide, we'll delve into proven strategies to expedite your student loan repayment journey and introduce you to a notable brand that aligns with these financial goals.

Strategic Principal Payments: Unleashing Financial Freedom

The cornerstone of accelerating your student loan repayment is strategically channeling extra funds toward the principal balance. By surpassing the minimum monthly requirement, you curtail the interest accumulation, effectively shortening the loan tenure. For instance, consider a $10,000 loan with a 5% interest rate and a 10-year term. Injecting an additional $100 per month could potentially save you a substantial $1,322 in interest, allowing you to bid farewell to your debt 2.5 years earlier.

Refinancing for Financial Liberation

Enter the realm of refinancing, a powerful tool to reshape your financial landscape. Collaborating with a private lender can lead to a lower interest rate, a truncated repayment term, or both. Imagine holding $50,000 in student loans with an average interest rate of 7%. Refinancing this to a 5% interest rate and a 10-year term could translate to savings of $8,474 in interest and a monthly payment reduction of $66². However, it's crucial to note that refinancing eligibility hinges on factors like a commendable credit score, a stable income, and a favorable debt-to-income ratio.

Unlocking the Potential of Loan Forgiveness Programs

For those dedicated to public service, education, healthcare, or military service, loan forgiveness or repayment assistance programs offer a pathway to financial relief. Programs like Public Service Loan Forgiveness (PSLF) provide forgiveness after 120 qualifying monthly payments while working full-time for a qualifying employer³. Teachers may explore the Teacher Loan Forgiveness program, forgiving up to $17,500 after five consecutive years in a low-income school⁴. Diverse professions boast similar programs, presenting opportunities to significantly reduce or eliminate student debt.

Harnessing Windfalls and Extra Income

Capitalizing on unexpected financial windfalls can be a game-changer in your quest for student loan freedom. Tax refunds, bonuses, inheritances, gifts, or additional income from side hustles can be strategically deployed to chip away at your principal balance. Picture a $3,000 tax refund applied to a loan with a 6% interest rate and a 10-year term—this move could save you $1,080 in interest and shave off 7 months from your repayment period.

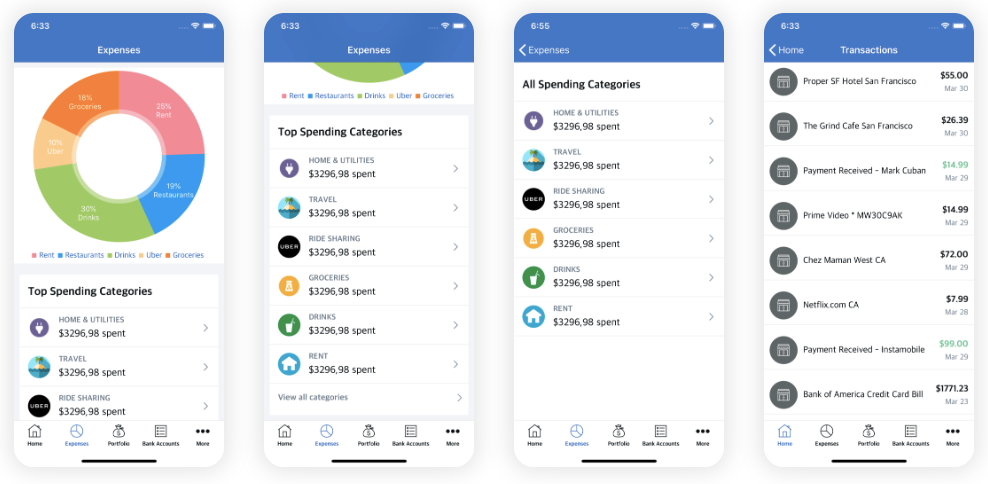

Financial Empowerment through Budgeting Apps

In the digital age, budgeting apps emerge as unsung heroes in the journey toward financial wellness. These tools empower you to meticulously track spending and savings, aligning your budget with income and expenses. Mint, a leading budgeting app, syncs seamlessly with your financial accounts, aiding in creating a personalized budget, setting goals, and providing actionable insights to enhance your financial standing.

By integrating these strategies into your financial repertoire, you not only expedite your journey to a debt-free life but also position yourself as a savvy steward of your financial well-being. As you navigate these pathways to financial freedom, consider the overarching impact on your credit score, income stability, and long-term financial goals.

In conclusion, liberating yourself from student loan burdens requires a multifaceted approach. Strategic principal payments, refinancing, exploring forgiveness programs, leveraging windfalls, and embracing budgeting apps collectively form a formidable arsenal in your pursuit of financial freedom.